What Percent of Net Worth Should Be in Your Home?

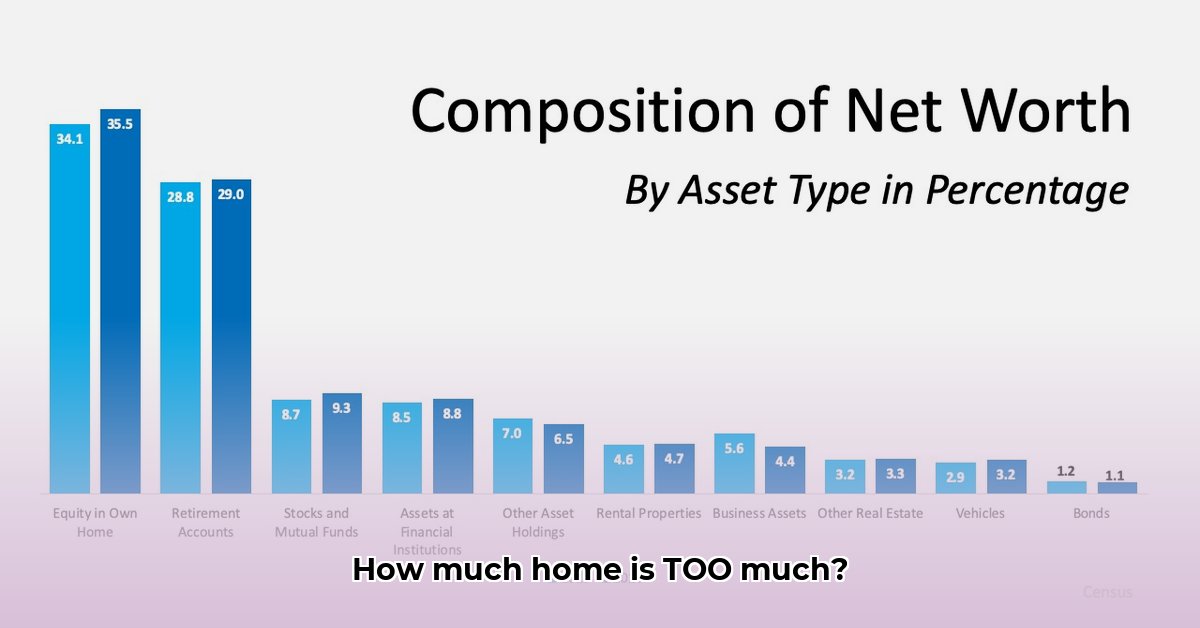

Determining the ideal percentage of your net worth allocated to your home is a crucial financial decision, especially as retirement nears. There's no magic number; the optimal percentage depends entirely on your unique circumstances. Your home is a significant asset, but it shouldn't be your only asset. Over-reliance on home equity can leave you vulnerable to market fluctuations. A diversified portfolio is essential for long-term financial security. Isn't financial flexibility a key component of a comfortable retirement?

Taking Stock of Your Financial Health

Before calculating percentages, assess your overall financial health. What are your retirement aspirations? Do you dream of traveling or pursuing hobbies? Understanding your goals clarifies your risk tolerance. How diversified is your investment portfolio? Do you hold stocks, bonds, and savings accounts? Diversification acts as a safety net, mitigating losses in any single asset class. Your home, while valuable, is less liquid (harder to quickly convert to cash) than other investments.

Debunking the 20-30% Rule

The often-cited 20-30% rule is a simplistic guideline. It overlooks crucial individual factors like age, retirement timeline, and risk tolerance. Consider two individuals: a young couple and a pre-retiree. The younger couple might comfortably allocate a larger percentage to their home, confident in future income growth. Conversely, someone nearing retirement might prefer greater liquidity for unforeseen expenses.

Crafting Your Personalized Home Equity Strategy

Let's create a personalized homeownership strategy through these actionable steps:

Define Your Retirement Vision: Envision your ideal retirement lifestyle. How much income will you need? This determines your savings and investment goals.

Understand Your Risk Tolerance: Are you a conservative or aggressive investor? Your comfort level with market volatility influences your asset allocation.

Diversify Your Investments: Avoid concentrating wealth in a single asset. Spread your investments across stocks, bonds, real estate (potentially including rental properties), and other suitable options. This strategy minimizes risk.

Factor in Your Time Horizon: Are you decades from retirement or nearing it? Your investment strategy should align with your timeline.

Regularly Review and Adjust: Your financial situation evolves. Regularly review your plan, making adjustments as needed.

Home Equity and Retirement Planning

Home equity plays a unique role in retirement planning. Many use it as a supplemental income source through downsizing or reverse mortgages. However, these strategies involve significant decisions, potential tax implications, and lifestyle changes. Careful planning and professional advice are crucial.

Age and Home Equity: A General Guide

Age strongly influences home equity allocation. Younger homeowners often have higher risk tolerance and longer time horizons, justifying larger allocations. As retirement approaches, individuals often prioritize liquidity and security, reducing their home equity percentage.

| Age Range | Typical Home Equity Percentage (Net Worth) | Considerations |

|---|---|---|

| 25-45 | 30-40% | Building wealth, higher risk tolerance, longer time horizon |

| 45-60 | 20-30% | Balancing risk and stability, nearing retirement |

| 60+ | 10-20% (or less) | Closer to retirement, prioritizing liquidity and security |

Disclaimer: This table provides a general guideline. Individual circumstances dictate the optimal allocation. Consulting a financial advisor is strongly recommended.

How to Adjust Home Equity Allocation Based on Life Stage and Financial Goals

Understanding Your Home Equity's Role

Your home is likely your most valuable asset. However, it shouldn't dominate your investment strategy. A balanced approach considers your life stage and financial aspirations. A young professional might prioritize wealth accumulation, while a retiree might focus on liquidity.

Life Stage and Equity Allocation

Let's explore how life stage impacts your home equity strategy:

Young Professionals (20s-30s): Focus on building wealth and financial foundations. Moderate home equity, prioritizing debt reduction and diversified investments.

Established Families (30s-50s): Balance home equity with retirement savings and other investments. Careful debt management is key.

Approaching Retirement (50s-60s): Assess risk tolerance, considering downsizing or supplementing retirement income with home equity.

Retirees (60s+): Home equity can provide a safety net, but ensure sufficient liquid assets for daily expenses.

Diversification: The Cornerstone of Success

Regardless of age, diversification is crucial. Over-reliance on a single asset exposes you to significant risk. A diversified portfolio cushions against market fluctuations.

The Importance of Your Financial Goals

Your goals—retirement, education, legacy—shape your home equity strategy. Aggressive retirement savings might necessitate a lower home equity percentage.

Actionable Steps

- Assess your current financial situation: Analyze income, expenses, debts, and assets.

- Define your financial goals: What are your priorities?

- Determine your risk tolerance: How comfortable are you with market volatility?

- Consider market conditions: Evaluate the current state of the housing market.

- Consult a financial advisor: Develop a tailored plan.

Regularly review and adjust your strategy as your circumstances change. Your home is a valuable asset, but it's one piece of a holistic financial plan.